Multiple Choice

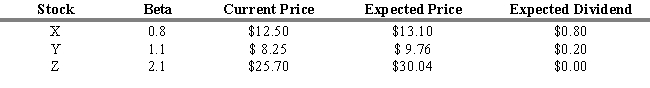

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 7.4. If the expected return on the market is 11.5% and the risk-free rate of return is 4.5%, then what are the required rates of return for stocks X, Y, and Z based on the CAPM? X Y Z

A) 4.8% 18.3% 16.9%

B) 7.2% 20.7% 22.3%

C) 10.7% 17.5% 14.4%

D) 10.1% 12.2% 19.2%

E) 11.1% 12.2% 21.3%

Correct Answer:

Verified

Correct Answer:

Verified

Q47: The expected return for a stock, calculated

Q48: The APT does not require a market

Q49: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q50: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q51: Assume that as a portfolio manager the

Q53: The expected return for Zbrite stock calculated

Q54: USE THE INFORMATION BELOW FOR THE

Q55: If an incorrect proxy market portfolio such

Q56: Assume that as a portfolio manager the

Q57: USE THE INFORMATION BELOW FOR THE