Multiple Choice

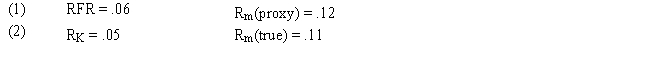

Assume that as a portfolio manager the beta of your portfolio is 1.4 and that your performance is exactly on target with the SML data under condition 1. If the true SML data is given by condition 2, how much does your performance differ from the true SML?

A) 2.0 percent lower

B) 0.5 percent lower

C) 0.5 percent lower.

D) 1.0 percent higher

E) 2.0 percent higher

Correct Answer:

Verified

Correct Answer:

Verified

Q2: A study by Chen, Roll, and Ross

Q3: Which of the following is NOT a

Q4: A stock has a beta of 1.25.

Q5: Beta can be thought of as indexing

Q6: Securities with returns that lie above the

Q7: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q8: The APT assumes that capital markets are

Q9: Using the S&P index as the proxy

Q10: Which of the following is not a

Q11: The excess return form of the