Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

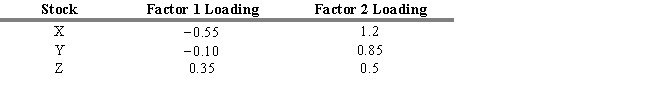

Consider the three stocks, stock X, stock Y, and stock Z, that have the following factor loadings (or factor betas) .

The zero-beta return ( 0) = 3 percent, and the risk premia are 1 = 10 percent and 2 = 8 percent. Assume that all three stocks are currently priced at $50.

The zero-beta return ( 0) = 3 percent, and the risk premia are 1 = 10 percent and 2 = 8 percent. Assume that all three stocks are currently priced at $50.

-Refer to Exhibit 7.9. The expected prices one year from now for stocks X, Y, and Z are

A) $53.55, $54.4, $55.25

B) $45.35, $54.4, $55.25

C) $55.55, $56.35, $57.15

D) $50, $50, $50

E) $51.35, $47.79, $51.58.

Correct Answer:

Verified

Correct Answer:

Verified

Q127: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q128: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q129: The table below provides factor risk sensitivities

Q130: A 1994 study by Burmeister, Roll, and

Q131: Consider the following list of risk factors:

Q133: Studies strongly suggest that the CAPM be

Q134: Calculate the expected return for A Industries,

Q135: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q136: Consider a two-factor APT model in which

Q137: In a multifactor model, time horizon risk