Multiple Choice

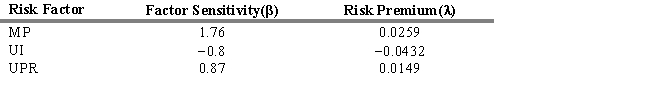

The table below provides factor risk sensitivities and factor risk premia for a three-factor model for a particular asset, where factor 1 is MP (the growth rate in U.S. industrial production) , factor 2 is UI (the difference between actual and expected inflation) , and factor 3 is UPR (the unanticipated change in bond credit spread) .  Calculate the expected excess return for the asset.

Calculate the expected excess return for the asset.

A) 12.32 percent

B) 9.32 percent

C) 4.56 percent

D) 6.32 percent

E) 8.02 percent

Correct Answer:

Verified

Correct Answer:

Verified

Q124: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q125: The equation for the single-index market model

Q126: Assume the risk-free rate is 4.5 percent

Q127: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q128: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q130: A 1994 study by Burmeister, Roll, and

Q131: Consider the following list of risk factors:

Q132: USE THE INFORMATION BELOW FOR THE

Q133: Studies strongly suggest that the CAPM be

Q134: Calculate the expected return for A Industries,