Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

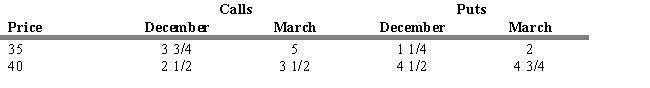

On the last day of October, Bruce Springsteen is considering the purchase of 100 shares of Olivia Corporation common stock selling at $37 1/2 per share and is considering an Olivia option.

-Refer to Exhibit 14.1. If Bruce decides to buy a March call option with an exercise price of 35, what is his dollar gain (loss) if he closes his position when the stock is selling at 43 1/2?

A) $225.00 loss

B) $350.00 loss

C) $225.00 gain

D) $350.00 gain

E) $850.00 gain

Correct Answer:

Verified

Correct Answer:

Verified

Q47: Forward and future contracts, as well as

Q48: The payoffs to both the long and

Q49: Consider a stock that is currently trading

Q50: A stock currently trades for $25. January

Q51: The price at which a futures contract

Q53: In the forward market, both parties are

Q54: All features of a forward contract are

Q55: The forward market has low liquidity relative

Q56: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q57: An equity portfolio manager can neutralize the