Multiple Choice

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

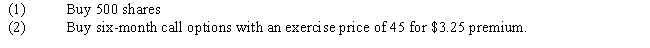

Rick Thompson is considering the following alternatives for investing in Davis Industries, which is now selling for $44 per share:

-Refer to Exhibit 14.2. Assuming no commissions or taxes, what is the annualized percentage gain if the stock reaches $50 in four months and a call was purchased?

A) 161.54 percent gain

B) 53.85 percent gain

C) 161.54 percent loss

D) 11.11 percent gain

E) 53.85 percent loss

Correct Answer:

Verified

Correct Answer:

Verified

Q51: The price at which a futures contract

Q52: USE THE INFORMATION BELOW FOR THE FOLLOWING

Q53: In the forward market, both parties are

Q54: All features of a forward contract are

Q55: The forward market has low liquidity relative

Q57: An equity portfolio manager can neutralize the

Q58: The value of a call option just

Q59: A stock currently sells for $15 per

Q60: Which of the following statements is FALSE?<br>A)

Q61: There are a number of differences between