Multiple Choice

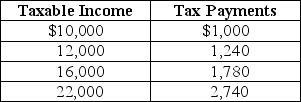

Table 18-4

Table 18-4 shows the amount of taxes paid on various levels of income.

Table 18-4 shows the amount of taxes paid on various levels of income.

-Refer to Table 18-4.The tax system is

A) progressive throughout all levels of income.

B) proportional throughout all levels of income.

C) regressive throughout all levels of income.

D) progressive between $10,000 and $12,000 of income and regressive between $16,000 and $22,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q32: Figure 18-4 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4186/.jpg" alt="Figure 18-4

Q34: Table 18-5<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4186/.jpg" alt="Table 18-5

Q36: Table 18-7<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4186/.jpg" alt="Table 18-7

Q39: Between 1970 and 2006,the poverty rate in

Q92: The Arrow impossibility theorem<br>A)explains why people can

Q141: As a group, people with high incomes

Q149: When the demand for a product is

Q154: The average tax rate is calculated as<br>A)total

Q178: If you pay $14,000 in taxes on

Q194: The federal government and some state governments