Multiple Choice

Use the following information to answer the question(s) below.

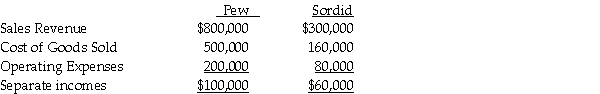

Pew Corporation acquired 80% ownership of Sordid Incorporated,at a time when Pew's investment cost was equal to 80% of Sordid's book value.At the time of acquisition,the book values and fair values of Sordid's assets and liabilities were equal.Pew uses the equity method.During 2011,Pew sold goods to Sordid for $160,000 making a gross profit percentage of 20%.Half of these goods remained unsold in Sordid's inventory at the end of the year.Income statement information for Pew and Sordid for 2011 were as follows:

-On January 1,2011,Plastam Industries acquired an 80% interest in Sparta Company to assure a steady supply of Sparta's inventory that Plastam uses in its own manufacturing businesses.Sparta sold 100% of its output to Plastam during 2011 and 2012 at a markup of 125% of Sparta's cost.Plastam had $12,000 of these items remaining in its inventory at December 31,2012.If Plastam neglected to eliminate unrealized profits from all intercompany sales from Sparta,the inventory on the consolidated balance sheet at December 31,2012 was

A) overstated by $1,920.

B) understated by $1,920.

C) overstated by $2,400.

D) understated by $2,400.

Correct Answer:

Verified

Correct Answer:

Verified

Q24: A(n)_ sale is a sale by a

Q25: Use the following information to answer the

Q26: Use the following information to answer the

Q27: Use the following information to answer the

Q29: PreBuild Manufacturing acquired 100% of Shoding Industries

Q31: Use the following information to answer the

Q32: Use the following information to answer the

Q33: Use the following information to answer the

Q34: Psalm Enterprises owns 90% of the outstanding

Q35: Penguin Corporation acquired a 60% interest in