Essay

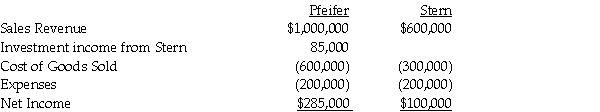

Pfeifer Corporation acquired an 80% interest in Stern Corporation several years ago when the book values and fair values of Stern's assets and liabilities were equal.At the time of acquisition, the cost of the 80% interest was equal to 80% of the book value of Stern's net assets.Separate company income statements for Pfeifer and Stern for the year ended December 31, 2011 are summarized as follows:

During 2010, Pfeifer sold merchandise that cost $120,000 to Stern for $180,000.Half of this merchandise remained in Stern's inventory at December 31, 2010.During 2011, Pfeifer sold merchandise that cost $150,000 to Stern for $225,000.One-third of this merchandise remained in Stern's December 31, 2011 inventory.

During 2010, Pfeifer sold merchandise that cost $120,000 to Stern for $180,000.Half of this merchandise remained in Stern's inventory at December 31, 2010.During 2011, Pfeifer sold merchandise that cost $150,000 to Stern for $225,000.One-third of this merchandise remained in Stern's December 31, 2011 inventory.

Required:

Prepare a consolidated income statement for Pfeifer Corporation and Subsidiary for 2011.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Use the following information to answer the

Q9: Preen Corporation acquired a 60% interest in

Q10: Peel Corporation acquired a 80% interest in

Q22: Use the following information to answer the

Q25: Assume there are routine inventory sales between

Q26: Use the following information to answer the

Q30: Use the following information to answer the

Q31: Use the following information to answer the

Q34: Psalm Enterprises owns 90% of the outstanding

Q36: Pirate Transport bought 80% of the outstanding