Essay

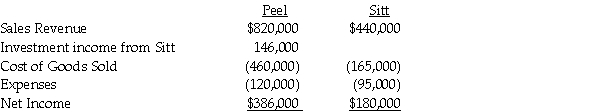

Peel Corporation acquired a 80% interest in Sitt Corporation at a cost equal to 80% of the book value of Sitt several years ago.At the time of purchase, the fair value and book value of Sitt's assets and liabilities were equal.Sitt purchases its entire inventory from Peel at 150% of Peel's cost.During 2011, Peel sold $190,000 of merchandise to Sitt.Sitt's beginning and ending inventories for 2011 were $72,000 and $66,000, respectively.Income statement information for both companies for 2011 is as follows:

Required:

Required:

Prepare a consolidated income statement for Peel Corporation and Subsidiary for 2011.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Preen Corporation acquired a 60% interest in

Q12: Use the following information to answer the

Q13: Pittle Corporation acquired a 80% interest in

Q14: Paulee Corporation paid $24,800 for an 80%

Q15: PreBuild Manufacturing acquired 100% of Shoding Industries

Q22: Use the following information to answer the

Q25: Assume there are routine inventory sales between

Q26: Use the following information to answer the

Q31: Use the following information to answer the

Q36: Pirate Transport bought 80% of the outstanding