Essay

PreBuild Manufacturing acquired 100% of Shoding Industries common stock on January 1, 2010, for $670,000 when the book values of Shoding's assets and liabilities were equal to their fair values and Shoding's stockholders' equity consisted of $380,000 of Capital Stock and $290,000 of Retained Earnings.

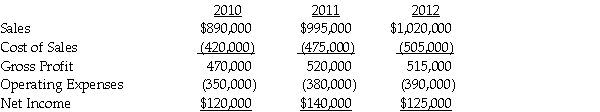

PreBuild's separate income (excluding investment income from Shoding)was $870,000, $830,000 and $960,000 in 2010, 2011 and 2012, respectively.PreBuild sold inventory to Shoding during 2010 at a gross profit of $50,000 and 50% remained at Shoding at the end of the year.The remaining 50% was sold in 2011.At the end of 2011, PreBuild has $54,000 of inventory received from Shoding from a sale of $180,000 which cost Shoding $150,000.There are no unrealized profits in the inventory of PreBuild or Shoding at the end of 2012.PreBuild uses the equity method in its separate books.Select financial information for Shoding follows:

Required:

Required:

Prepare a schedule to determine PreBuild Manufacturing's Consolidated net income for 2010, 2011, and 2012.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Peel Corporation acquired a 80% interest in

Q12: Use the following information to answer the

Q13: Pittle Corporation acquired a 80% interest in

Q14: Paulee Corporation paid $24,800 for an 80%

Q16: Pexo Industries purchases the majority of their

Q17: Penguin Corporation acquired a 60% interest in

Q18: Proman Manufacturing owns a 90% interest in

Q23: A parent company regularly sells merchandise to

Q26: Use the following information to answer the

Q27: Use the following information to answer the