Essay

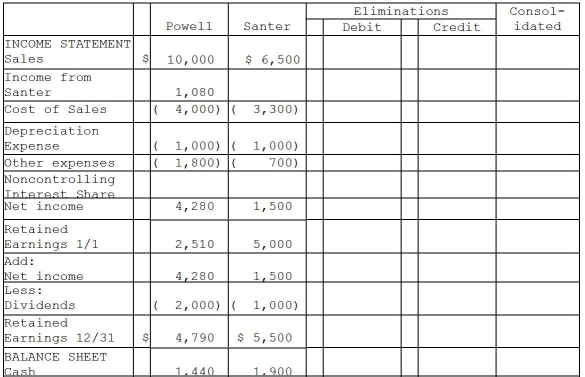

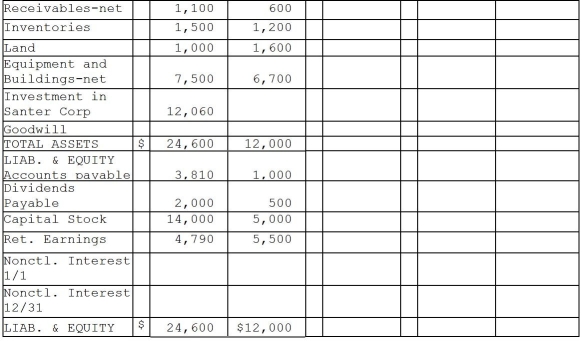

Powell Corporation acquired 90% of the voting stock of Santer Corporation on January 1, 2010 for $11,700 when Santer had Capital Stock of $5,000 and Retained Earnings of $4,000.The amounts reported on the financial statements approximated fair value, with the exception of inventories, which were understated on the books by $500 and were sold in 2010, land which was undervalued by $1,000, and equipment with a remaining useful life of 5 years under the straight-line method which was undervalued by $1,500.Any remainder was assigned to goodwill.

Financial statements for Powell and Santer Corporations at the end of the fiscal year ended December 31, 2011 appear in the first two columns of the partially completed consolidation working papers.Powell has accounted for its investment in Santer using the equity method of accounting.Powell Corporation owed Santer Corporation $100 on open account at the end of the year.Dividends receivable in the amount of $450 payable from Santer to Powell is included in Powell's net receivables.

Required:

Complete the consolidation working papers for Powell Corporation and Subsidiary for the year ended December 31, 2011.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: On consolidated working papers,a subsidiary's net income

Q8: Which of the following will be debited

Q16: Pecan Incorporated acquired 80% of the voting

Q16: In contrast with single entity organizations,consolidated financial

Q21: On January 2, 2011, Paleon Packaging purchased

Q22: Bird Corporation has several subsidiaries that are

Q23: On December 31, 2010, Patenne Incorporated purchased

Q24: Packo Company acquired all the voting stock

Q35: At the beginning of 2011,Parling Food Services

Q48: When preparing consolidated financial statements,which of the