Essay

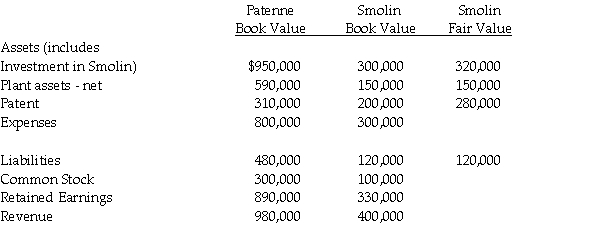

On December 31, 2010, Patenne Incorporated purchased 60% of Smolin Manufacturing for $300,000.The book value and fair value of Smolin's assets and liabilities were equal with the exception of plant assets which were undervalued by $60,000 and had a remaining life of 10 years, and a patent which was undervalued by $40,000 and had a remaining life of 5 years.At December 31, 2012, the companies showed the following balances on their respective adjusted trial balances:

Requirement 1: Calculate the balance in the Plant assets - net and the Patent accounts on the consolidated balance sheet as of December 31, 2012.

Requirement 1: Calculate the balance in the Plant assets - net and the Patent accounts on the consolidated balance sheet as of December 31, 2012.

Requirement 2: Calculate consolidated net income for 2012, and the amount allocated to the controlling and noncontrolling interests.

Requirement 3: Calculate the balance of the noncontrolling interest in Smolin to be reported on the consolidated balance sheet at December 31, 2012.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: On consolidated working papers,a subsidiary's net income

Q8: Which of the following will be debited

Q13: When performing a consolidation,if the balance sheet

Q19: Powell Corporation acquired 90% of the voting

Q21: On January 2, 2011, Paleon Packaging purchased

Q22: Bird Corporation has several subsidiaries that are

Q24: Packo Company acquired all the voting stock

Q25: Flagship Company has the following information collected

Q26: Puddle Corporation acquired all the voting stock

Q27: Parakeet Company has the following information collected