Essay

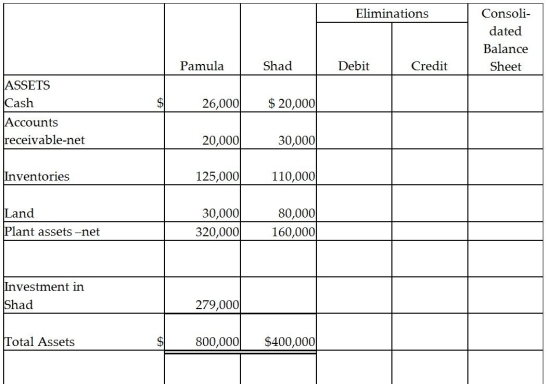

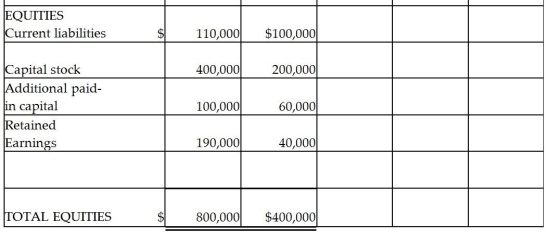

Pamula Corporation paid $279,000 for 90% of Shad Corporation's $10 par common stock on December 31, 2011, when Shad Corporation's stockholders' equity was made up of $200,000 of Common Stock, $60,000 Additional Paid-in Capital and $40,000 of Retained Earnings.Shad's identifiable assets and liabilities reflected their fair values on December 31, 2011, except for Shad's inventory which was undervalued by $5,000 and their land which was undervalued by $2,000.Balance sheets for Pamula and Shad immediately after the business combination are presented in the partially completed working papers.

Required:

Required:

Complete the consolidated balance sheet working papers for Pamula Corporation and Subsidiary.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Push-down accounting<br>A)requires a subsidiary to use the

Q4: On January 1, 2011, Parry Incorporated paid

Q5: On June 1,2011,Puell Company acquired 100% of

Q6: On January 1, 2005, Myna Corporation issued

Q7: On January 1, 2011, Pinnead Incorporated paid

Q14: Pattalle Co purchases Senday, Inc.on January 1

Q16: A newly acquired subsidiary had pre-existing goodwill

Q24: On July 1,2011,Polliwog Incorporated paid cash for

Q35: Pomograte Corporation bought 75% of Sycamore Company's

Q45: Subsequent to an acquisition,the parent company and