Essay

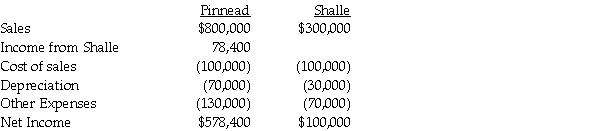

On January 1, 2011, Pinnead Incorporated paid $300,000 for an 80% interest in Shalle Company.At that time, Shalle's total book value was $300,000.Patents were undervalued in the amount of $10,000.Patents had a 5-year remaining useful life, and any remaining excess value was attributed to goodwill.The income statements for the year ended December 31, 2011 of Pinnead and Shalle are summarized below:

Requirements:

Requirements:

1.Calculate the goodwill that will appear in the consolidated balance sheet of Pinnead and Subsidiary at December 31, 2011.

2.Calculate consolidated net income for 2011.

3.Calculate the noncontrolling interest share for 2011.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Push-down accounting<br>A)requires a subsidiary to use the

Q3: The consolidated balance sheet of Pasker Corporation

Q4: On January 1, 2011, Parry Incorporated paid

Q5: On June 1,2011,Puell Company acquired 100% of

Q6: On January 1, 2005, Myna Corporation issued

Q9: Pamula Corporation paid $279,000 for 90% of

Q16: A newly acquired subsidiary had pre-existing goodwill

Q18: Pregler Inc.has 70% ownership of Sach Company,but

Q24: On July 1,2011,Polliwog Incorporated paid cash for

Q35: Pomograte Corporation bought 75% of Sycamore Company's