Multiple Choice

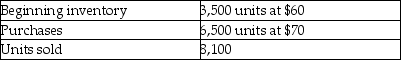

Given the following data, by how much would taxable income change if LIFO is used rather than FIFO?

A) Decrease by $15,000

B) Decrease by $19,000

C) Increase by $15,000

D) Increase by $19,000

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q37: The units of inventory available for sale

Q38: The disclosure principle requires that management prepare

Q39: If ending inventory is overstated by $6,000,

Q40: Under a perpetual inventory system, when a

Q41: Purr Company's ending inventory was $106,700 at

Q43: If a company's records are destroyed by

Q44: The conservatism principle dictates that inventory be

Q46: Football, Inc.'s clerk made a mistake while

Q47: Toyland's inventory records show the following data

Q53: The inventory cost under the average cost