Essay

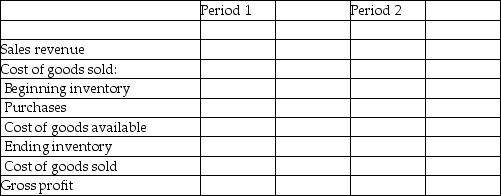

Football, Inc.'s clerk made a mistake while preparing the financial statements. The ending inventory for Year 1 should have been $20,000, but the clerk recorded it as $23,000 on the income statement. Assume that sales for Years 1 and 2 are $90,000 per year and purchases are $20,000 per year. Beginning inventory for Year 1 of $12,000 and ending inventory for Year 2 of $21,000 were correctly recorded. Complete the following income statement for Year 1 and 2.

Correct Answer:

Verified

Correct Answer:

Verified

Q41: Purr Company's ending inventory was $106,700 at

Q42: Given the following data, by how much

Q43: If a company's records are destroyed by

Q44: The conservatism principle dictates that inventory be

Q47: Toyland's inventory records show the following data

Q48: If Martson and Co. make the following

Q49: Bronx Company's ending inventory (at cost) was

Q50: The journal entry to record the purchase

Q51: Given the following data, calculate the cost

Q53: The inventory cost under the average cost