Multiple Choice

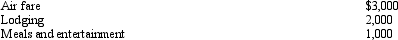

During the year,Oscar travels from Raleigh to Moscow (Russia) on business.His time was spent as follows: 2 days travel (one day each way) ,2 days business,and 2 days personal.His expenses for the trip were as follows (meals and lodging reflect only the business portion) :  Presuming no reimbursement,Oscar's deductible expenses are:

Presuming no reimbursement,Oscar's deductible expenses are:

A) $6,000.

B) $5,500.

C) $4,500.

D) $3,500.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Tom owns and operates a lawn maintenance

Q41: Bill is employed as an auditor by

Q42: Arnold is employed as an assistant manager

Q69: Bob lives and works in Newark, NJ.He

Q73: A deduction for parking and other traffic

Q89: For tax purposes, travel is a broader

Q92: Jackson gives his supervisor a $30 box

Q109: Janet, who lives and works in Newark,

Q109: Kelly, an unemployed architect, moves from Boston

Q141: Daniel just graduated from college.The cost of