Essay

Arnold is employed as an assistant manager in the furniture division of a national chain of department stores.He is a recent college graduate with a degree in marketing.During 2012,he enrolls in the evening MBA program of a local university and incurs the following expenses: tuition,$4,200; books and computer supplies,$800; transportation expense to and from the university,$450; and meals while on campus,$400.Arnold is single and his annual AGI is $66,000.As to these expenses,what are Arnold's:

Correct Answer:

Verified

Correct Answer:

Verified

Q1: A taxpayer who lives and works in

Q11: Employees who render an adequate accounting to

Q38: During the year,Oscar travels from Raleigh to

Q41: Bill is employed as an auditor by

Q73: A deduction for parking and other traffic

Q89: For tax purposes, travel is a broader

Q104: Allowing for the cutback adjustment (50% reduction

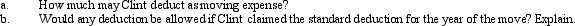

Q109: Kelly, an unemployed architect, moves from Boston

Q111: A statutory employee is not a common

Q141: Daniel just graduated from college.The cost of