Multiple Choice

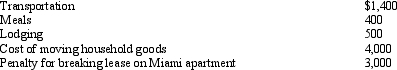

Due to a merger,Allison transfers from Miami to Chicago.Under a new job description,she is reclassified from employee to independent contractor status.Her moving expenses,which are not reimbursed,are as follows:  Allison's deductible moving expense is:

Allison's deductible moving expense is:

A) $0.

B) $5,900.

C) $6,100.

D) $8,900.

E) $9,300.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q6: Dave is the regional manager for a

Q24: In the case of an office in

Q32: Elsie lives and works in Detroit. She

Q46: Once the actual cost method is used,

Q47: Once set for a year, when might

Q54: Tired of renting, Dr.Smith buys the academic

Q110: Ava holds two jobs and attends graduate

Q111: During the year,Peggy went from Nashville to

Q116: Aiden is the city sales manager for

Q118: A taxpayer just changed jobs and incurred