Multiple Choice

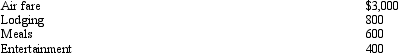

During the year,Peggy went from Nashville to Quito (Ecuador) on business.She spent four days on business,two days on travel,and four days on vacation.Disregarding the vacation costs,Peggy's unreimbursed expenses are:  Peggy's deductible expenses are:

Peggy's deductible expenses are:

A) $2,500.

B) $2,800.

C) $3,100.

D) $4,300.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q24: In the case of an office in

Q46: Once the actual cost method is used,

Q47: Once set for a year, when might

Q107: If a business retains someone to provide

Q108: Travel status requires that the taxpayer be

Q109: During the year,Walt went from Louisville to

Q110: Ava holds two jobs and attends graduate

Q115: Due to a merger,Allison transfers from Miami

Q116: Aiden is the city sales manager for

Q153: An education expense deduction is not allowed