Multiple Choice

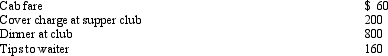

Henry entertains several of his key clients on January 1 of the current year.Expenses paid by Henry are as follows:  Presuming proper substantiation,Henry's deduction is:

Presuming proper substantiation,Henry's deduction is:

A) $1,220.

B) $740.

C) $640.

D) $610.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q23: Under the actual cost method, which, if

Q34: Jacob is a landscape architect who works

Q70: After graduating from college with a degree

Q102: Qualifying job search expenses are deductible even

Q103: Which, if any, of the following factors

Q119: When using the automatic mileage method, which,

Q125: Tired of her 60 mile daily commute,

Q127: A worker may prefer to be classified

Q129: Ralph made the following business gifts during

Q130: Rod uses his automobile for both business