Essay

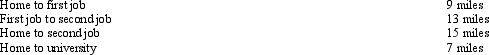

Rod uses his automobile for both business and personal use and claims the automatic mileage rate for all purposes.During 2012,his mileage was as follows:

How much can Rod claim for mileage?

How much can Rod claim for mileage?

Correct Answer:

Verified

$6,313 [(8,800 miles ´ $0.555,...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: Under the actual cost method, which, if

Q34: Jacob is a landscape architect who works

Q70: After graduating from college with a degree

Q102: Qualifying job search expenses are deductible even

Q103: Which, if any, of the following factors

Q113: Every year, Penguin Corporation gives each employee

Q119: When using the automatic mileage method, which,

Q125: Tired of her 60 mile daily commute,

Q129: Ralph made the following business gifts during

Q131: Henry entertains several of his key clients