Essay

Gwen went to Paris on business.While there,she spent 60% of the time on business and 40% on vacation.How much of the air fare of $4,000 can she deduct based on the following assumptions:

Correct Answer:

Verified

Transportation costs for mixed use (i.e...

Transportation costs for mixed use (i.e...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: Under the right circumstances, a taxpayer's meals

Q24: Marvin lives with his family in Alabama.

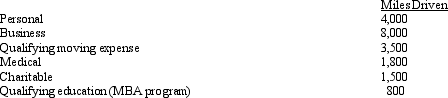

Q37: Nick Lee is a linebacker for the

Q53: Ryan performs services for Jordan. Which, if

Q96: Felicia,a recent college graduate,is employed as an

Q101: Regarding § 222 (qualified higher education deduction

Q102: Alfredo,a self-employed patent attorney,flew from his home

Q110: Which, if any, of the following is

Q148: Mallard Corporation furnishes meals at cost to

Q160: In November 2012, Katie incurs unreimbursed moving