Essay

Regarding § 222 (qualified higher education deduction for tuition and related expenses),comment on the following:

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q17: Under the right circumstances, a taxpayer's meals

Q37: Nick Lee is a linebacker for the

Q45: One of the tax advantages of being

Q96: Felicia,a recent college graduate,is employed as an

Q97: Gwen went to Paris on business.While there,she

Q102: Alfredo,a self-employed patent attorney,flew from his home

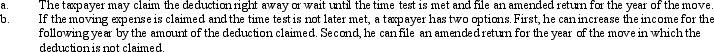

Q113: A moving expense deduction is allowed even

Q134: A taxpayer who claims the standard deduction

Q148: Mallard Corporation furnishes meals at cost to

Q153: An education expense deduction is not allowed