Essay

Discuss the 2%-of-AGI floor and the 50% cutback limitation in connection with various employee expenses under the following arrangements:

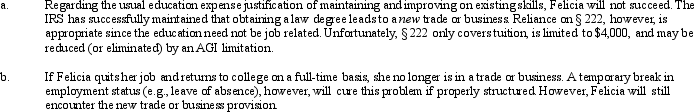

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q16: In terms of income tax treatment, what

Q42: Logan, Caden, and Olivia are three unrelated

Q51: Tickets to a theater performance or sporting

Q70: Ramon and Ingrid work in the field

Q71: In the current year,Bo accepted employment with

Q77: Ashley and Matthew are husband and wife

Q81: There is no cutback adjustment for meals

Q121: The Federal per diem rates that can

Q130: Alexis (a CPA and JD) sold her

Q158: At age 65, Camilla retires from her