Essay

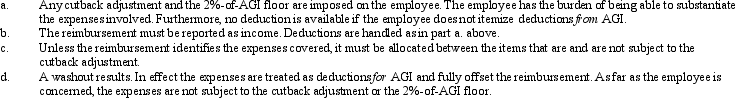

Ramon and Ingrid work in the field of public relations and incur sizable entertainment expenses.Ramon is employed by a consumer products company,while Ingrid is a self-employed consultant.Regarding the tax treatment of the entertainment expenses,when would:

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q42: Logan, Caden, and Olivia are three unrelated

Q51: Tickets to a theater performance or sporting

Q67: Discuss the 2%-of-AGI floor and the 50%

Q71: In the current year,Bo accepted employment with

Q77: Ashley and Matthew are husband and wife

Q84: Dove Corporation pays for a trip to

Q100: The portion of the office in the

Q121: The Federal per diem rates that can

Q151: In May 2012, after 11 months on

Q158: At age 65, Camilla retires from her