Multiple Choice

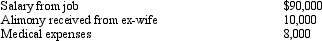

Larry,a calendar year cash basis taxpayer,has the following transactions:  Based on this information,Larry has:

Based on this information,Larry has:

A) AGI of $46,500.

B) AGI of $51,000.

C) AGI of $60,000.

D) Deduction for medical expenses of $0.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q4: Legal fees incurred in connection with a

Q8: Depending on the nature of the expenditure,

Q35: A vacation home at the beach which

Q47: Marge sells land to her adult son,

Q54: If an activity involves horses, a profit

Q75: Janice is single,had gross income of $38,000,and

Q81: Robyn rents her beach house for 60

Q95: In determining whether an activity should be

Q97: If a residence is used primarily for

Q101: A taxpayer who claims the standard deduction