Multiple Choice

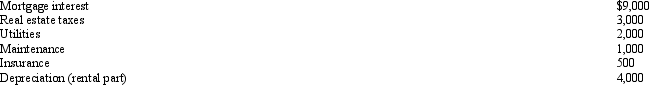

Robyn rents her beach house for 60 days and uses it for personal use for 30 days during the year.The rental income is $6,000 and the expenses are as follows:  Using the IRS approach,total expenses that Robyn can deduct on her tax return associated with the beach house are:

Using the IRS approach,total expenses that Robyn can deduct on her tax return associated with the beach house are:

A) $0.

B) $6,000.

C) $8,000.

D) $12,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Legal fees incurred in connection with a

Q11: Assuming an activity is deemed to be

Q37: Benita incurred a business expense on December

Q51: If a vacation home is determined to

Q54: If an activity involves horses, a profit

Q76: Larry,a calendar year cash basis taxpayer,has the

Q78: Generally, a closely held family corporation is

Q85: While she was a college student,Juliet worked

Q95: In determining whether an activity should be

Q101: A taxpayer who claims the standard deduction