Multiple Choice

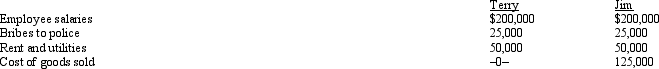

Terry and Jim are both involved in operating illegal businesses.Terry operates a gambling business and Jim operates a drug running business.Both businesses have gross revenues of $500,000.The businesses incur the following expenses.  Which of the following statements is correct?

Which of the following statements is correct?

A) Neither Terry nor Jim can deduct any of the above items in calculating the business profit.

B) Terry should report profit from his business of $250,000.

C) Jim should report profit from his business of $500,000.

D) Jim should report profit from his business of $250,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q47: Are all personal expenses disallowed as deductions?

Q78: Generally, a closely held family corporation is

Q82: Paula is the sole shareholder of Violet,

Q92: Andrew,who operates a laundry business,incurred the following

Q93: Melba incurred the following expenses for her

Q115: If an item such as property taxes

Q118: A cash basis taxpayer who charges an

Q124: Which of the following can be claimed

Q152: Which of the following is deductible as

Q153: Tommy, an automobile mechanic employed by an