Multiple Choice

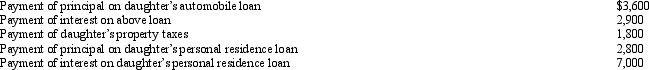

Melba incurred the following expenses for her dependent daughter during the current year:  How much may Melba deduct in computing her itemized deductions?

How much may Melba deduct in computing her itemized deductions?

A) $0.

B) $8,800.

C) $11,700.

D) $18,100.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q47: Are all personal expenses disallowed as deductions?

Q67: Trade and business expenses should be treated

Q81: Briefly discuss the two tests that an

Q91: Terry and Jim are both involved in

Q92: Andrew,who operates a laundry business,incurred the following

Q115: If an item such as property taxes

Q118: A cash basis taxpayer who charges an

Q124: Which of the following can be claimed

Q152: Which of the following is deductible as

Q153: Tommy, an automobile mechanic employed by an