Multiple Choice

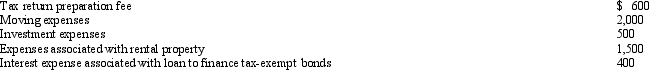

Cory incurred and paid the following expenses:  Calculate the amount that Cory can deduct (before any percentage limitations) .

Calculate the amount that Cory can deduct (before any percentage limitations) .

A) $5,000.

B) $4,600.

C) $3,000.

D) $1,500.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q2: Salaries are considered an ordinary and necessary

Q5: The ordinary and necessary expenses for operating

Q11: If a vacation home is rented for

Q19: Albie operates an illegal drug-running business and

Q21: Arnold and Beth file a joint return.Use

Q88: LD Partnership, a cash basis taxpayer, purchases

Q107: In January, Lance sold stock with a

Q139: Briefly discuss the disallowance of deductions for

Q141: Two-thirds of treble damage payments under the

Q151: Which of the following is incorrect?<br>A) Alimony