Essay

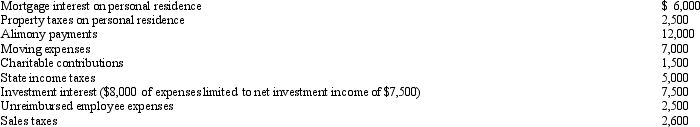

Arnold and Beth file a joint return.Use the following data to calculate their deduction for AGI.

Correct Answer:

Verified

Arnold and Beth's deduction for AGI is $...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Arnold and Beth's deduction for AGI is $...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q2: Salaries are considered an ordinary and necessary

Q13: For an activity classified as a hobby,

Q17: Cory incurred and paid the following expenses:

Q19: Albie operates an illegal drug-running business and

Q41: Amos, a shareholder-employee of Pigeon, Inc., receives

Q88: LD Partnership, a cash basis taxpayer, purchases

Q107: In January, Lance sold stock with a

Q122: Which of the following expenses associated with

Q125: Which of the following are deductions for

Q139: Briefly discuss the disallowance of deductions for