Multiple Choice

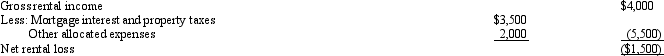

Bob and April own a house at the beach.The house was rented to unrelated parties for 8 weeks during the year.April and the children used the house 12 days for their vacation during the year.After properly dividing the expenses between rental and personal use,it was determined that a loss was incurred as follows:  What is the correct treatment of the rental income and expenses on Bob and April's joint income tax return for the current year assuming the IRS approach is used if applicable?

What is the correct treatment of the rental income and expenses on Bob and April's joint income tax return for the current year assuming the IRS approach is used if applicable?

A) A $1,500 loss should be reported.

B) Only the mortgage interest and property taxes should be deducted.

C) Since the house was used more than 10 days personally by Bob and April, the rental expenses (other than mortgage interest and property taxes) are limited to the gross rental income in excess of deductions for interest and taxes allocated to the rental use.

D) Since the house was used less than 50% personally by Bob and April, all expenses allocated to personal use may be deducted.

E) Bob and April should include none of the income or expenses related to the beach house in their current year income tax return.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: The income of a sole proprietorship are

Q39: Robin and Jeff own an unincorporated hardware

Q80: For purposes of the § 267 loss

Q86: A political contribution to the Democratic Party

Q91: All employment related expenses are classified as

Q114: For a vacation home to be classified

Q143: Marvin spends the following amounts on a

Q147: Rose's business sells air conditioners which have

Q149: Brenda invested in the following stocks and

Q150: Kitty runs a brothel (illegal under state