Essay

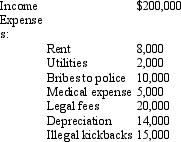

Kitty runs a brothel (illegal under state law)and has the following items of income and expense.What is the amount that she must include in taxable income from her operation?

Correct Answer:

Verified

The bribes to polic...

The bribes to polic...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q7: If a vacation home is classified as

Q11: The income of a sole proprietorship are

Q14: The only § 212 expenses that are

Q39: Robin and Jeff own an unincorporated hardware

Q86: A political contribution to the Democratic Party

Q91: All employment related expenses are classified as

Q146: Bob and April own a house at

Q147: Rose's business sells air conditioners which have

Q149: Brenda invested in the following stocks and

Q152: Sandra sold 500 shares of Wren Corporation