Essay

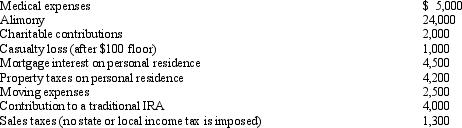

Austin,a single individual with a salary of $100,000,incurred and paid the following expenses during the year:

Calculate Austin's deductions for AGI.

Calculate Austin's deductions for AGI.

Correct Answer:

Verified

Only the following e...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Only the following e...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q12: On January 2, 2012, Fran acquires a

Q21: Alice incurs qualified moving expenses of $12,000.

Q22: If a taxpayer cannot satisfy the three-out-of-five

Q36: For a vacation home to be classified

Q72: All domestic bribes (i.e., to a U.S.official)

Q85: If a vacation home is classified as

Q110: Al single,age 60,and has gross income of

Q111: Calculate the net income includible in taxable

Q128: The Code defines what constitutes a trade

Q137: Which of the following cannot be deducted