Multiple Choice

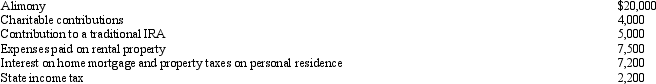

Al single,age 60,and has gross income of $140,000.His deductible expenses are as follows:  What is Al's AGI?

What is Al's AGI?

A) $94,100.

B) $103,500.

C) $107,500.

D) $127,500.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q22: If a taxpayer cannot satisfy the three-out-of-five

Q36: For a vacation home to be classified

Q69: Iris, a calendar year cash basis taxpayer,

Q87: If a vacation home is a personal/rental

Q106: Austin,a single individual with a salary of

Q111: Calculate the net income includible in taxable

Q113: In order to protect against rent increases

Q115: Sandra owns an insurance agency.The following selected

Q128: The Code defines what constitutes a trade

Q137: Which of the following cannot be deducted