Essay

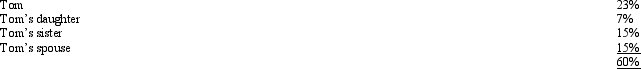

The stock of Eagle,Inc.is owned as follows:

Tom sells land and a building to Eagle,Inc.for $212,000.His adjusted basis for these assets is $225,000.Calculate Tom's realized and recognized loss associated with the sale.

Tom sells land and a building to Eagle,Inc.for $212,000.His adjusted basis for these assets is $225,000.Calculate Tom's realized and recognized loss associated with the sale.

Correct Answer:

Verified

Tom's realized loss is $13,000.

Howeve...

Howeve...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: A football team that pays a star

Q6: Ordinary and necessary business expenses, other than

Q14: Beige, Inc., an airline manufacturer, is conducting

Q34: The period in which an accrual basis

Q63: Max opened his dental practice (a sole

Q87: If a vacation home is a personal/rental

Q113: In order to protect against rent increases

Q115: Sandra owns an insurance agency.The following selected

Q120: Alfred's Enterprises,an unincorporated entity,pays employee salaries of

Q121: Why are there restrictions on the recognition