Essay

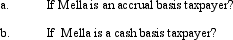

In order to protect against rent increases on the building in which she operates a dance studio,Mella signs an 18-month lease for $36,000.The lease commences on October 1,2012.How much of the $36,000 payment can she deduct in 2012 and 2013?

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q2: A football team that pays a star

Q22: If a taxpayer cannot satisfy the three-out-of-five

Q36: For a vacation home to be classified

Q69: Iris, a calendar year cash basis taxpayer,

Q87: If a vacation home is a personal/rental

Q110: Al single,age 60,and has gross income of

Q111: Calculate the net income includible in taxable

Q115: Sandra owns an insurance agency.The following selected

Q118: The stock of Eagle,Inc.is owned as follows:<br>

Q121: Why are there restrictions on the recognition