Multiple Choice

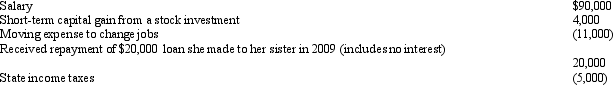

In 2012,Pierre had the following transactions:  Pierre's AGI is:

Pierre's AGI is:

A) $83,000.

B) $94,000.

C) $98,000.

D) $103,000.

E) $114,000.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q16: In terms of the tax formula applicable

Q42: The kiddie tax does not apply as

Q69: When separate income tax returns are filed

Q73: Kyle and Liza are married and under

Q88: In early 2012, Ben sold a yacht,

Q89: A decrease in a taxpayer's AGI could

Q94: Married taxpayers who file separately cannot later

Q106: Which, if any, of the statements regarding

Q123: For the year a spouse dies, the

Q132: During 2012,Jackson had the following capital gains