Essay

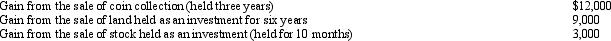

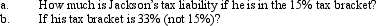

During 2012,Jackson had the following capital gains and losses:

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q57: Tony, age 15, is claimed as a

Q69: When separate income tax returns are filed

Q84: Homer (age 68) and his wife Jean

Q89: A decrease in a taxpayer's AGI could

Q94: Married taxpayers who file separately cannot later

Q96: Which, if any, of the following is

Q123: For the year a spouse dies, the

Q131: When filing their Federal income tax returns,the

Q137: In 2012,Pierre had the following transactions: <img

Q141: The filing status of a taxpayer (e.g.,