Multiple Choice

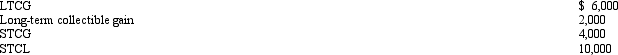

During 2012,Trevor has the following capital transactions:  After the netting process,the following results:

After the netting process,the following results:

A) Long-term collectible gain of $2,000.

B) LTCG of $6,000, Long-term collectible gain of $2,000, and a STCL of $6,000.

C) LTCG of $6,000, Long-term collectible gain of $2,000, and a STCL carryover to 2013 of $3,000.

D) LTCG of $2,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q19: Lee, a citizen of Korea, is a

Q44: Taylor had the following transactions for 2012:<br>

Q47: Regarding the Tax Tables applicable to the

Q53: Butch and Minerva are divorced in December

Q55: A dependent cannot claim a personal exemption

Q72: When the kiddie tax applies, the child

Q105: The major advantage of being classified as

Q115: Pedro is married to Consuela, who lives

Q120: Ed is divorced and maintains a home

Q131: Once they reach age 65, many taxpayers