Essay

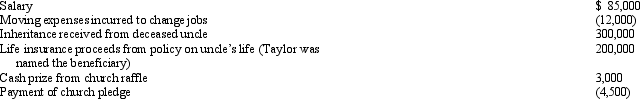

Taylor had the following transactions for 2012:

What is Taylor's AGI for 2012?

What is Taylor's AGI for 2012?

Correct Answer:

Verified

$76,000.$85,000 (salary)+ $3,000 (raffle...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

$76,000.$85,000 (salary)+ $3,000 (raffle...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q5: Tom is single and for 2012 has

Q36: Which of the following items, if any,

Q44: Adjusted gross income (AGI) appears at the

Q49: During 2012,Trevor has the following capital transactions:

Q53: Butch and Minerva are divorced in December

Q55: A dependent cannot claim a personal exemption

Q59: During the current year, Doris received a

Q64: In January 2012, Jake's wife dies and

Q105: The major advantage of being classified as

Q131: Once they reach age 65, many taxpayers