Essay

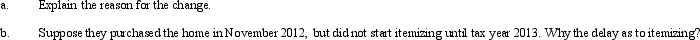

When filing their Federal income tax returns,the Youngs always claimed the standard deduction.After they purchased a home,however,they started to itemize their deductions from AGI.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q57: Tony, age 15, is claimed as a

Q69: When separate income tax returns are filed

Q84: Homer (age 68) and his wife Jean

Q89: A decrease in a taxpayer's AGI could

Q94: Married taxpayers who file separately cannot later

Q96: Which, if any, of the following is

Q111: Using borrowed funds from a mortgage on

Q123: For the year a spouse dies, the

Q132: During 2012,Jackson had the following capital gains

Q141: The filing status of a taxpayer (e.g.,