Essay

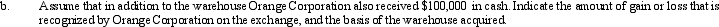

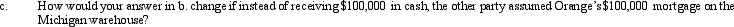

a.Orange Corporation exchanges a warehouse located in Michigan (adjusted basis of $560,000)for a warehouse located in Ohio (adjusted basis of $450,000; fair market value of $525,000).Indicate the amount of gain or loss that is recognized by Orange Corporation on the exchange,and the basis of the warehouse acquired.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Under what circumstances may a partial §

Q30: On October 1, Paula exchanged an apartment

Q43: A condemned office building owned and used

Q45: Samuel's hotel is condemned by the City

Q48: If boot in the form of cash

Q56: During 2012, Ted and Judy, a married

Q58: Which of the following might motivate a

Q59: Which of the following satisfy the time

Q102: Lenny and Beverly have been married and

Q192: In order to qualify for like-kind exchange