Essay

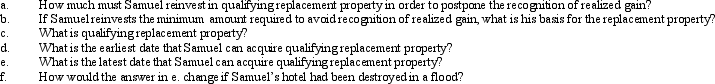

Samuel's hotel is condemned by the City Housing Authority on July 5,2012,for which he is paid condemnation proceeds of $950,000.He first received official notification of the pending condemnation on May 2,2012.Samuel's adjusted basis for the hotel is $600,000 and he uses a fiscal year for tax purposes with a September 30 tax year-end.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: The basis of boot received in a

Q30: On October 1, Paula exchanged an apartment

Q35: Shari exchanges an office building in New

Q41: a.Orange Corporation exchanges a warehouse located in

Q43: A condemned office building owned and used

Q48: If boot in the form of cash

Q48: Mandy and Greta form Tan,Inc.,by transferring the

Q58: Which of the following might motivate a

Q59: Which of the following satisfy the time

Q77: Lily exchanges a building she uses in