Essay

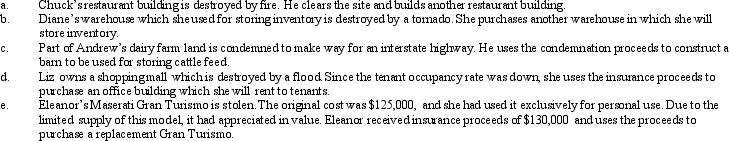

For each of the following involuntary conversions,determine if the property qualifies as replacement property.

Correct Answer:

Verified

All of the replacements qualify as repla...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

All of the replacements qualify as repla...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q9: Beth sells investment land (adjusted basis of

Q10: Jake exchanges an airplane used in his

Q25: Don, who is single, sells his personal

Q25: If there is an involuntary conversion (i.e.,

Q37: In a nontaxable exchange, the replacement property

Q79: A taxpayer who sells his or her

Q85: Evelyn's office building is destroyed by fire

Q159: Define an involuntary conversion.

Q163: During 2012, Howard and Mabel, a married

Q176: Carl sells his principal residence, which has