Essay

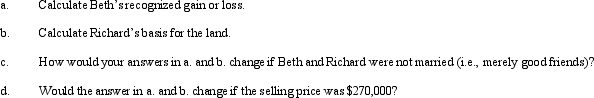

Beth sells investment land (adjusted basis of $225,000)that she has owned for 6 years to her husband,Richard,for its fair market value of $195,000.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q5: For each of the following involuntary conversions,determine

Q10: Jake exchanges an airplane used in his

Q37: In a nontaxable exchange, the replacement property

Q79: A taxpayer who sells his or her

Q102: How does the replacement time period differ

Q146: Distinguish between a direct involuntary conversion and

Q159: Define an involuntary conversion.

Q163: During 2012, Howard and Mabel, a married

Q176: Carl sells his principal residence, which has

Q271: The holding period of replacement property where