Essay

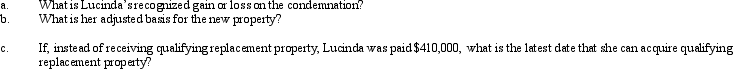

Lucinda,a calendar year taxpayer,owned a rental property with an adjusted basis of $312,000 in a major coastal city.Her property was condemned by the city government on October 12,2012.In order to build a convention center,Lucinda eventually received qualified replacement property from the city government on March 9,2013.This new property has a fair market value of $410,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Peach, Inc., owns a delivery truck (cost

Q14: Molly exchanges a small machine (adjusted basis

Q49: Under what circumstance is there recognition of

Q71: During 2012, Zeke and Alice, a married

Q72: Use the following data to determine the

Q101: Which of the following statements is correct

Q114: Jena owns land as an investor.She exchanges

Q129: Kitty, who is single, sells her principal

Q132: A realized gain on an indirect (conversion

Q132: Which of the following is correct?<br>A)The deferral