Essay

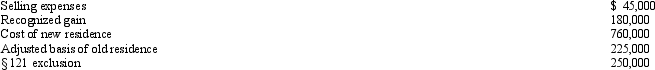

Use the following data to determine the sales price of Etta's principal residence and the realized gain.She is not married.The sale of the old residence qualifies for the § 121 exclusion.

Correct Answer:

Verified

The sale of residence model can be used ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: Peach, Inc., owns a delivery truck (cost

Q55: Alex used the § 121 exclusion three

Q68: Lucinda,a calendar year taxpayer,owned a rental property

Q71: During 2012, Zeke and Alice, a married

Q73: The surrender of depreciated boot (fair market

Q76: If a taxpayer reinvests the net proceeds

Q101: Which of the following statements is correct

Q114: Jena owns land as an investor.She exchanges

Q132: Which of the following is correct?<br>A)The deferral

Q270: Matt, who is single, sells his principal